Wednesday, December 20, 2006

FLASH: All Major Indicators Keep Tumbling, Bureau Reports

On Behalf Of: Small Business California

Sent: Wednesday, December 20, 2006 7:34 AM

Subject: FLASH: All Major Indicators Keep Tumbling, Bureau Reports

Please see update on workers compensation. All good news.

http://www.wcexec.com/articles/WCE01-20061220-000.htm.aspx.

Yesterday, I met Speaker Nunez's people and Senator Perata's people on the health insurance issue.They are very interested in getting the views of small business and will continue to discuss with us proposals as they move forward. As I have said the Speaker has a spot bill AB 8, which will be his vehicle for addressing the issue. This bill has no specifics at this time.

Senator Perata has a Shared responsibility bill which would require individuals to purchase insurance for themselves and their dependents and employers will also be asked to contribute. A purchasing pool called the "Connector" would be set up by The Managed Risk Medical Insurance Board. It would take advantage of Federal funding opportunities. Employers of course would be able to continue their own group coverage to cover their employees, but if they don't there would be some as yet undetermined cost they would have to pay for each employee.

It is estimated that 4.2 million of the currently uninsured would get coverage under this proposal. I emphasized the importance of cost containment to small business and the fears we have of anything moving forward that will place a severe burden on small business.

What are your thoughts on this? What is the message you would like me to send to the Governor, Speaker Nunez and Senator Perata? At this point Small Business California does not have a position on any bills and won't until more details are put forward. Senator Perata is to be applauded for putting something forth that the Governor can work with, but the devil is always in the details.

If you would like a more complete summary of the proposal let me know and I will send it to you.

Friday, December 01, 2006

Dennis Trinidad

Sent: Thursday, November 30, 2006 6:28 AM

To: Small Business California

Subject: Dennis Trinidad

It is with great sadness that I report to you that Dennis Trinidad, the state Small Business Advocate has resigned. I think today is his last day.

Dennis has been a great friend for Small Business California and all small businesses in the state of California. I have been involved in small business advocacy for going on 25 years and Dennis would be without doubt one of the best people I have ever worked with in advocating the interest of small business. He cares deeply about small business and really wanted to have the voice of small business heard in Sacramento and around the state.

I would encourage you to send an email to Dennis today thanking him for all his efforts.

He can be reached at Dennis.Trinidad@OPR.CA.GOV

Dennis, you have a lot of friends around the state and thank you for all your efforts on our behalf.

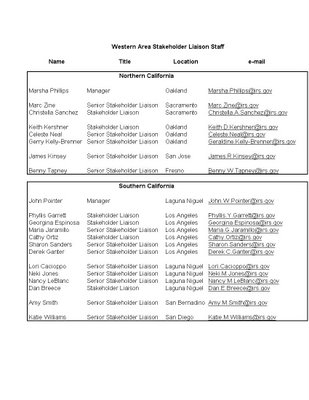

IRS Stakeholder Liaison Staff List

Sent: Wednesday, November 22, 2006 6:38 AM

To: Small Business California

Subject: IRS Stakeholder Liaison Staff List

Please find contacts if you have any questions about Federal tax issues. They also are available to meet with groups to discuss these issues and they welcome your email.

Things are relatively quite in Sacramento right now as the session is closed. Look forward to next year being a big year in the discussion of how to deal with the medically uninsured. The Governor has indicated that he will be making a major announcement on this issue at his state of the state message and Small Business California has been meeting with his point people providing the small business perspective.

Sam Wallace who was appointed by the Governor as the Small Enterprise Officer is working on a strategic plan to implement the Governors Executive Order S-11-06 to foster the greater utilization of Small Business in the states contracting for construction on transportation and highway related projects tied to the Governors Strategic Growth Plan.

The Executive order includes:

Creation of a Small Business Expansion Fund in the amount of $4 million from the Federal Highway Administration to guarantee up to $17 million in loans.

Legislative proposal for establishing a $40 million State Transportation Bonding Guarantee Program to assist small businesses in bidding on transportation projects.

This will be within the Business Transportation and Housing agency but our good friend Dennis Trinidad who is the states Small Business Advocate will also be working on the implementation of this Executive Order.

If you would like more information on this please contact me.

Have a wonderful Thanksgiving.

Tuesday, November 14, 2006

Elections/ IRS/ Volunteers in Medicine

Sent: Monday, November 13, 2006 6:28 AM

To: Small Business California

Subject: Elections/ IRS/ Volunteers in Medicine

So the election is over and it is time to move forward on a small business agenda for next year. I have asked in the past for ideas for legislation SB Cal could sponsor and I am asking again. Please give me your ideas if you have not already done so.

I would also like to know if you have a relationship with a state Senator or Assemblyman. I would like to keep track of your contacts as legislation unfolds next year. Please let me know of your contacts by return email

On another front I want to remind you that the IRS is targeting small businesses to reduce the $290 billion tax gap. Commissioner Kevin Brown announced that the division is planning a significant increase in audits of small businesses.

The Commissioner has estimated that 75% of this tax gap can be traced to small business owners. Of course we all feel that small businesses should pay what we owe but the tax code is extremely complicated and there is a real fear that small business owners will be paying a lot of interest and penalties for minor errors and misunderstandings.

In the spring I will be getting you more information on what you can do to protect yourself but please let me know if you have been the recipient of an IRS audit in the last year.

The last point and I am gloating here is that the Volunteers In Medicine Institute will be recognized Tuesday night by the Manhattan Institute for our work in developing clinics around the country. The program takes retired doctors,nurses and dentist and allows them to provide health services to the working uninsured. We now have 50 clinics around the country the most recent one in San Diego. I will be going to New York tomorrow to be part of the awards ceremony. I am Vice Chair of VIMI. For more information about us go to www.vimi.org

Monday, November 06, 2006

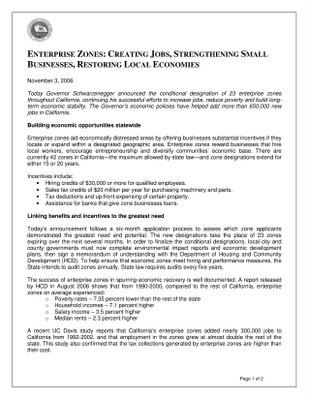

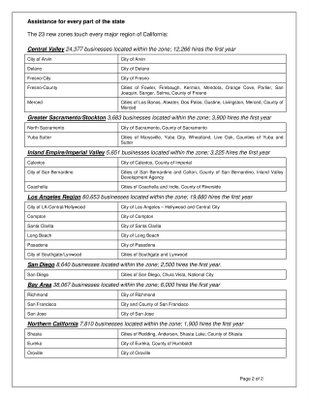

Enterprise Zones

Sent: Monday, November 06, 2006 10:56 AM

To: Small Business California

Subject: Enterprise Zones

I have found that many small business owners around the state are not familiar with Enterprise Zones. Last week the Governor announced the conditional designation of 23 Enterprise Zones. If you are located in an Enterprise Zone and you have hired additional people you may be eligible for thousands of dollars. Please see Zones and details below.

If you want more information please contact me.

Also last week the Insurance Commissioner approved a 9.3% reduction in the pure loss rate effective Jan 1. Companies do not have to accept these and will be doing their filings in the next 45 days. I would fully expect most carriers to be reducing their rates Jan 1.

Wednesday, November 01, 2006

AB 32 / Health Debate

Sent: Tuesday, October 31, 2006 7:00 AM

To: Small Business California

Subject: AB 32 / Health Debate

These are exciting times for Small Business California. On Wednesday Hank Ryan and I will be traveling to Washington DC where Small Business California will be doing a briefing on AB 32 {Greenhouse Emissions]in the Senate offices. Last week Senator Diane Feinstein and Senator Snowe sent out a Dear Colleagues letter encouraging the Senators and or their staff to attend the event. We also know that a number of states from around the country will have representatives. The discussion will be around global warming and AB 32 and how other states can follow California's lead in implementing green house emission caps.

That evening Small Business California will be honored at a reception put on by the Center for Small Business and the Environment and our good friend Byron Kennard.

Small Business California is getting calls from around the country on this and is being asked by states to help them to bring small business to the table in their states.

On the health front you all know that the Governor is expected to make a major announcement , assuming he is reelected, about how he plans to deal with the uninsured in California. Over the last month we have met or talked to Herb Schultz, John Remy, and Carol Liu in the Governors office, the Blue Shield Foundation , Blue Shield of California, Kaiser, Steve Westly, Lucian Wulsin at The Insure the Uninsured Project and David Panush in Senator Perata's office.

A group of small business owners have been put together to attend some of these meetings and Nov 6 that group will again be talking to Herb Schultz.

As always we welcome your comments on the above issues or any issue that effects small businesses around the state.

Thursday, October 19, 2006

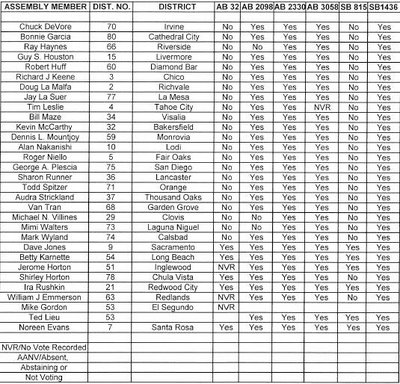

Assembly & Senate Vote

Sent: Thursday, October 19, 2006 11:11 AM

To: Small Business California

Subject: FW: Assembly & Senate Vote

This is a long email but actually very important and a quick read. We have listed the most important bills to Small Business California this and the votes of every legislator in the state. Find your legislator in the Assembly and the Senate and see how they voted.

If you talk to them or their staff thank them for there votes.

Scott Hague President Small Business California

phone: 415 680-2188

http://www.smallbusinesscalifornia.org/

http://www.smallbusinesscalifornia.blogspot.com/

"The voice of California Small Business"

Supported Bills:

-AB32 [Pavley/Nunez] Landmark emissions reduction legislation. SB-Cal was the first CA business organization to support this legislation and we lobbied in Sacramento to insure passage noting the importance of balancing emissions reduction with incentives for CA businesses to exchange lost profits wasting energy for investments that will pay for themselves through lower energy costs. This bill puts the CA Clean Tech sector on the forefront to maximize innovation and new job creation in the race to supply the world with alternative energy technologies

-AB2098 [Liu] Sponsored-Creates an electronic Funds Task Force which requires to examine California's current payment dispersal practices and determine opportunities for increased cost savings and user friendliness utilizing new EFT technology. Passed and awaiting Governors signature

-AB 2330 [Arambula] Requires through the Small Business Advocate to do a study of the cost of state regulations for small business. Passed and signed by the Governor

-AB3058 [Arambula] The bill will assist small businesses in developing a disaster plan- Passed and signed by the Governor

-SB1436 [Figueroa] Sponsored-Which will assist small businesses in complying with state regulation and requires state agencies to designate a liaison for small businesses to work with It also requires the department of Technology Services to create and maintain a user friendly website. Passed and signed by the Governor

Bills Opposed:

-SB 815 [ Perrata] Doubling of temporary disability payments on workers compensation claims. This bill would have dramatically increased workers comp rates over three years Passed and vetoed by the Governor

Wednesday, October 11, 2006

SB CAL Letter

Sent: Tuesday, October 10, 2006 1:50 PM

To: Scott Hauge

Subject: SB CAL Letter

Dear SB-Cal Supporter:

As I promised last week please see a review of what Small Business California has done this past year to represent your interest in Sacramento. To those of you who have joined Small Business California, thank you. For those of you who have not joined, we hope you will do so.

Please click on http://www.smallbusinesscalifornia.org/. You also may want to forward this email to others you know in the Small Business Community.

Small Business California has come a long way over the last two years in establishing a voice for grass roots small businesses. The email tree we have put in place to about 2400 small businesses has developed a reputation for providing the most current information about issues in Sacramento that affect small businesses.

We have become a trusted source of information not only to the media in California but around the nation. It also has generated thousand of letters and emails to legislators and the Governor supporting our positions.

Scott Hauge, President

Small Business California

Your Small Business Voice

Here are the bills that SB-Cal played a significant role in getting passed (or vetoed) this legislative session:

2006 Activities- Supported Bills

-SB 1436 [Figueroa] (SB-Cal sponsored) Will assist small businesses in complying with state regulation and requires state agencies to designate a liaison for small businesses to work with. It also requires the department of Technology Services to create and maintain a user friendly website. Passed and signed by the Governor

-AB 2098 [Liu] (SB-Cal sponsored) Creates an Electronic Funds Task Force to examine California's current payment dispersal practices and determine opportunities for increased cost savings and user friendliness utilizing new EFT technology. Passed and signed by the Governor.. -AB 32 [Pavley/Nunez] Landmark emissions reduction legislation. SB-Cal was the first CA business organization to support this legislation and we lobbied in Sacramento to insure passage, noting the importance of balancing emissions reduction with incentives for CA businesses to exchange profits lost through wasted energy for investments that will pay for themselves through lower energy costs. This bill puts the CA Clean Tech sector on the forefront to maximize innovation and new job creation in the race to supply the world with alternative energy technologies. We had language added to the bill requiring that Small Business be involved in implementation of the bill.

-AB 1835 [Lieber] Increase in the minimum wage. While this is controversial, SB-Cal supported it when it appeared that it was going to the ballot. Had it gone to the ballot it would have included indexing every year. SB-Cal tried to get a tip credit included, but failed. Passed and signed by the Governor

-SB 437 [Escutia] increased health insurance coverage for children in California. Passed and signed by the Governor

-AB 2330 [Arambula] Requires the Small Business Advocate to do a study of the cost of state regulations for small business. Passed and signed by the Governor

-AB 3058 [Arambula] Provides assistance to small businesses in developing a disaster plan. Passed and signed by the Governor

-AB173 [Maldonado] This bill would have allowed individuals who put money into a health savings account to take a state tax deduction aligned with the federal tax deduction, which is available. Failed in the Assembly

-AB 2277 [Villines] This bill would require posters that the employer must post to be in plain understandable language. Failed in Assembly

-AB2217 [Villines] Allow employers the ability to schedule their workweek so that overtime is paid after 40 hours. Failed in Assembly

Bills Opposed

-SB 815 [Perata] Doubling of temporary disability payments on workers compensation claims. This bill would have dramatically increased workers comp rates over three years. Passed but vetoed by the Governor

-AB 409 [Yee] Another Workers’ Comp bill, this would have removed the caps on chiropractor and physical therapist visits. Pulled by the Author

-AB1209 [Yee] Workers Comp bill would have dismantled Medical Provider Networks. Pulled by the author.

Other Activities

-Part of core group for Small Business Recognition day with the Governor

-Assisted in putting on Small Business forums around the state for Senator Peratta.

-Raised objections to a change in the Experience Modification by the Workers Compensation Insurance Rating Bureau. This would have cost a number of small businesses around the state millions of dollars.

-Attended Governors Health Summit and will playa role in the development of the Governors development of universal coverage

-Attended a press conference with the Governor announcing his Executive Order to increase Business Transportation and Housing Agency's contracting with small businesses for transportation contracts.

-Spoke with the Governor and speaker Nunez at the signing of the minimum wage bill.

-November 1st, Small Business California will be honored in Washington D.C. by the Center for Small Business and the Environment for our activity around AB32. That day we will also be part of a hearing in the Senates Office.

Tuesday, October 10, 2006

Ideas for Legislation

Sent: Thursday, October 05, 2006 9:40 AM

To: Small Business California

Subject: Ideas for Legislation

Small Business California has had an incredible year. We have increased the visibility of grass roots small businesses around the state and all of our major bills have been passed and signed by the Governor.

Next week I will send you a list of our accomplishments. One thing we are really proud of is our support of AB 32[ the greenhouse emissions bill]. On November 1 Hank Ryan and I will be going to Washington DC where SB Cal will be honored by the Center for Small Business and the Environment at a cocktail reception with a number of number of people in the environmental community. Even more exciting is that we will be part of a hearing that day probably on the Senate side to discuss small business involvement in the energy/global warming debate.

We are in the process of trying to develop a legislative package for next years session. Our board will be meeting next week. Please give me ideas of legislation you might want us to consider. Remember it must be state focused and in our core areas- health, workers compensation,education and workforce, infrastructure,regulations and energy. It also must be broad based legislation that effects most if not all small businesses not one industry or region.

I look forward to hearing from you.

Friday, September 29, 2006

AB32

Sent: Friday, September 29, 2006 7:20 AM

To: Small Business California

Subject: AB32

As you all know by now the Governor has signed AB 32. I attended the signing ceremony in SF but more importantly Small Business California played a major role in getting this passed and was I believe the first statewide generic business association to support this. This is the first time in history that small business has played a role in influencing the outcome of a major energy/global warming issue.

Small Business California also contacted the Governors office to try and get small business into the Governors comments at the signing. As a result the Governor said:

"AB 32 as a matter of fact,is good for business,not only large and well established businesses,but also small businesses that will harness their entrepreneurial spirit to help us achieve our climate goals. In fact, we will create a whole new industry to pump up our economy,a clean tech industry that creates jobs,sparks new cutting edge technology and will be a model for the rest of the nation and the rest of the world"

Thank you Governor. It is now important that small business keep engaged and be at the table when implementation decisions are made.

Thursday, September 28, 2006

AB32/ Health Insurance

Sent: Tuesday, September 26, 2006 6:34 AM

To: Small Business California

Subject: AB32/ Health Insurance

I just became aware that the Governor will be signing AB32[greenhouse emissions cap] at 10 o'clock on Wednesday in San Francisco and sometime I assume later that day in Los Angeles. I have talked to some of you about this event and passed some names to the Governor office at their request. Did any of you receive an invitation?

I met yesterday with Herb Schultz, John Remy and Ruth Liu who will be working on putting together a plan to deal with the uninsured. They are looking for input from small business people and I hope in the future I can call on some of you to get your thoughts. I especially want to work with other associations on this issue as this email goes to over 100 associations in the state.

I would appreciate hearing from you as individual business owners and as associations if you would like to work on this issue.

As the health insurance issue was the number one concern of small business in our survey I think it important that we have our voices heard.

Tuesday, September 26, 2006

SB815

Sent: Tuesday, September 19, 2006 4:48 PM

Subject: SB815

I know two emails in one day is awful but let me make this short. The Governor vetoed SB815. This was the bill that would double the permanent partial disability payments over 3 years. Assuming that the companies accept the Workers Compensation Insurance Rating Bureaus calculations this means policies that renew Jan 1 and later will have the January filed rates 8.3% lower than had he signed the bill. Keep in mind rates went down in July also so you will see a nice decrease in your workers comp cost at renewal assuming you have not had a lot of claims and your payroll has not increased dramatically.

For those of you that sent letters to the Governor thank you. We also need to thank the Governor for his veto.

San Francisco City Summit

Sent: Thursday, September 14, 2006 7:38 AM

To: Small Business California

Subject: San Francisco City Summit

The SF Chamber,SF Center for Economic Development and Mayor Newsom will be holding an Economic Summit September 26th from 7:30 to2 at the Mission Bay Conference Center. Featured speakers include Tom King President and CEO of PG&E, Supervisor Michela Alioto Pier,Bo Burlingham from Inc Magazine and of course Mayor Newsom.

The cost is $75 per person. For more information and to register on line go to www.sfchamber.com.

Small Business California is having a very successful year in Sacramento. Besides our successful efforts on AB 32[cap on greenhouse emission] which we worked on with the SF Chamber and the Bay Area Council we just received word that the Governor has signed our three bills SB1436 which will help small businesses with regulations,AB2330 which will provide for a study of the cost of state regulations for small businesses and AB3058 which will help small businesses develop a disaster plan. We are becoming a factor in Sacramento.

Lastly the workers compensation Bureau reported that a 6.3% reduction in workers compensation rates effective Jan 1,2007 will be recommended to to the Insurance Commissioner assuming SB 815 gets vetoed by the Governor. SB 815 would double the permanent disability cost over a three year period. The Bureau has said if this happens their recommendation will be revised to an increase January 1 of 1.8%. Rates will further be increased the following two years. Take a moment and send an email to Michael Prosio at www.michael.prosio@gov.ca.gov and copy Dennis Trinidad at Dennis.Trinidad@OPR.CA.GOV. asking the Governor to veto this bill.You all should know Dennis as he is the state Small Business Advocate and Small Business California was the driving force in getting the Governor to fund the position.

Workers Comp Rate Reduction/ IRS Targets Small Business/ Regulatory Fairness Hearing

Sent: Monday, September 11, 2006 6:25 AM

To: Small Business California

Subject: Workers Comp Rate Reduction/ IRS Targets Small Business/ Regulatory Fairness Hearing

Last week the Workers Compensation Insurance Rating Bureau announced that they are considering a 6% decrease in pure premium rates January 1 2007.If the WCIRB governing committee accepts this it will be sent to the Insurance Commissioner who will hold a public hearing September 28.

This all could change however if SB 815 gets signed by the Governor. In my email last week I mentioned that this would increase the Permanent Partial Disability schedules and result in an expected 16%plus increase in cost to the workers compensation system over a three year time period. I ask again that you send an email opposing SB815 to michael.prosio@gov.ca.gov and copy Dennis Trinidad at Dennis.Trinidad@OPR.CA.GOV. Please ask them to tell the Governor to veto this bill.

The IRS is targeting small businesses for tax audits. The so called "Tax Gap" is because the IRS believes that self employed and pass through small businesses are not paying what is legally due the IRS.

I was at a board meeting for the National Small Business Association[ NSBA] awhile back and an IRS representative said that he felt over $300 million could be recovered if small businesses were paying the proper IRS taxes.

While I certainly believe that small businesses that are not paying their taxes should do so I and the NSBA are concerned about harassment and intimidation by auditors. The NSBA over the next few months is beginning an initiative to raise awareness about the potential threat to small businesses around the country and will be providing information to inform small businesses about common mistakes in tax preparation. If you have been audited recently please let me know.

I also mentioned in a prior email the Regulatory Fairness Hearing in Sacramento. I just received a correction on this. It will be September 29 at the Sacramento Convention Center at 1401 J Street, Room 101 Sacramento. The registration is at 1:30 and the hearing from 2to 4. If you want to testify or submit something in writing you can contact Mary Conway-Jespen of the SBA Sacramento District Office at 916-930-3712 or email her at mary.conway-jespen@sba.gov

Wednesday, September 06, 2006

Urgent Action Needed to Protect Workers Compensation Reform

Sent: Tuesday, September 05, 2006 7:13 AM

To: Small Business California

Subject: FW: Urgent Action Needed to Protect Workers Compensation Reform

Small businesses have benefited greatly from the reforms of SB899 SB 228 and AB 227 We now need to protect these reforms by getting the Governor to veto three bills that have been sent to him by the legislature.

Please take a few minutes and send an email to Michael Prosio at mailto:michael.prosio@gov.ca.gov and cc Dennis Trinidad at mailto:Dennis.Trinidad@OPR.CA.GOV on each of these bills. I would also appreciate a copy.

This is your time to make a difference. We must stop SB815, AB1368 and AB2287. See information below from CCWC.

Have you ever been frustrated by a Federal Regulation. On September 29 at the Sacramento Convention Center 1400 J Street,Room 101 a hearing will be held to give small business people and business organizations the opportunity to voice their concerns. Registration is at 1:30 PM and the hearing will be from 2 to 4 with the SBA National Ombudsman Nicholas Owens and members of the SBA's Regulatory Fairness Board for Region 9. Kim King of King Security who receives this email sits on this Board and should you have any questions please contact her or me. She can be reached at mailto:kking@kingsecurity.netYou can also call Mary Conway-Jepsen of the SBA Sacramento District Office at 916-939-3712 or email her at mailto:mary.conway-jepsen@sba.gov. Testimony can be submitted in advance or at the hearing.

Scott Hauge

Small Business California

415-680-2188

CCWC Members,

California State Assembly and Senate End Legislative Session Late Thursday; Erosions to SB 899 Pass from Both Houses

Late Thursday night the California State Assembly and Senate passed several pieces of workers' compensation legislation that do nothing but erode the core set of reforms enacted in SB 228, AB 227 and SB 899. This legislation includes attempts to exempt public safety officers from crucial apportionment statutes, double the Permanent Partial Disability Benefit for workers injured after January 1, 2007, and create in statute a separate set of guidelines and fees for acupuncturists. The several pieces of legislation opposed by CCWC are:

* SB 815 (Perata-D) Workers' Compensation: Permanent Disability Benefits. For a copy of CCWC's letter requesting a veto, please click HERE <http://www.ccwcworkcomp.org/images/242_SB_815__Veto_Letter.pdf> . This legislation doubles the number of weeks afforded to an injured worker for injuries post January 1, 2007. Contrary to the stated intent of the legislation, this bill and benefit increase does NOTHING to address the perceived shortcomings of the existing Permanent Disability Rating Schedule (PDRS) effective January 1, 2005. Instead it only increases benefits for workers injured in 2007, 2008 and 2009. This legislation was strongly supported by Zenith Insurance Company President and CEO, Mr. Stanley Zaks who was represented by Senator Alarcon as saying that Zenith Insurance Company supported in the increase and could absorb the 16.6% increase in costs. Unfortunately with the increased litigation against the PDRS, it is more likely that should this legislation pass, Mr. Zaks would pass this cost onto his customers in California, reversing a trend of lower premiums and a more stable statewide workers' compensation system.

* AB 1368 (Karnette-D) Workers' Compensation: Presumptions: Apportionment. For a copy of CCWC's letter requesting a veto, please click HERE <http://www.ccwcworkcomp.org/images/244_AB_1368_Veto_Letter.pdf> . This legislation will exempt tens of public safety designations from the key apportionment tenants of SB 899 and disallow cities, counties, and local agencies from considering non-work factors and events in determining permanent disability the injured worker. Public Safety officers should be subject to the same rules and considerations as the rest of California's injured workers. CCWC strongly urges you to support our request that the Governor Vetoes this legislation.

* AB 2287 (Chu-D) Workers' Compensation: Acupuncture Guidelines and Utilization. For a copy of CCWC's letter requesting a veto, please click HERE <http://www.ccwcworkcomp.org/images/243_AB_2287_Veto_Letter.pdf> . This legislation creates in statute separate treatment guidelines and fee schedules for the use of acupuncture in the treatment of injured workers, something in SB 899 that was left up to the prevue of the Division of Workers' Compensation. CCWC believes it should remain the domain of the DWC and strongly urges you to support our call for a Veto.

Scott D. Lipton

Membership Director / Grassroots Organizer California Coalition on Workers' Compensation (CCWC)

AB 32- Caps On Greenhouse Emissions

Sent: Wednesday, August 30, 2006 5:05 PM

To: Small Business California

Subject: AB 32- Caps On Greenhouse Emissions

I just got word that the Governor and the legislature have come to an agreement and it is therefore expected that AB32 will pass both houses and be signed by the Governor. This bill would basically cap greenhouse emissions and is truly historic

Small Business California was I believe the first generic business group in the state to support this and we have been working hard in Sacramento and with legislators and the Governors people to get this done.

What makes this so great is that California will be able to plan for global warming which I think is now a scientific fact. We believe that planning certainly beats crisis management.

We also think this is going to create a huge industry and will provide opportunities for entrepreneurs to develop technologies to meet the demand that will be created by the cap. Small business will therefore be creating thousands of jobs which is what we do best.Lastly we think small businesses will have opportunities to find out how they can save energy and reduce our cost by using new technologies and learning about technologies that currently exist

Urgent Action Needed

Sent: Tuesday, August 29, 2006 3:03 PM

To: Small Business California

Subject: Urgent Action Needed

Please send your letters for AB2330, AB3058, and SB1436 . These have all passed the legislature and we need your help in getting the Governor to sign them.

Minimum Wage

Sent: Monday, August 21, 2006 5:11 PM

Subject: Minimum Wage

A big announcement is expected tomorrow according to Capital Notes. A deal has been struck increasing the minimum wage by $1.25 over two years. There is no cost of living increase attached to the measure.

As you may recall the Governor wanted an increase of $1.00 over two years. The Democrats wanted a cost of living increase attached. The above is the compromise.

This obviously could change overnight but it appears pretty solid.

Urgent Workers Compensation Information

Sent: Friday, August 18, 2006 7:29 AM

To: Small Business California

Subject: Urgent Workers Compensation Information

This is more information than I usually send but you have told us that workers compensation cost is a very important issue for you. There are two things really important going on in Sacramento right now you should be aware of. First Senator Perata is looking at revising the Permanent Disability Rating Schedule. This was a major part of the reforms and while it probably does need to be tweaked most people in the business community feel this should not be done until the Permanent Disability benefit study being done by the Division Of Workers Compensation is completed. See below how you can contact the Governor on this important matter.

Second there is a bill AB3026 [Sally Lieber] to exempt local government and local agency public safety officers from all aspects of managed care. This would be a major change from prior reforms. While it only applies to peace officers it will cost significant money for local governments and could be the start of unraveling reforms that have been so effective in lowering your workers compensation cost. See below for how you can give your thoughts on this.

SB Cal has opposed this and we would hope this will be vetoed by the Governor if it hits his desk.

Small Business California Bills Pass Committees

Sent: Tuesday, August 08, 2006 6:58 AM

To: Small Business California

Subject: Small Business California Bills Pass Committees

Yesterday two bills supported by Small Business California passed Senate appropriations and now go to the Senate floor.They are both by Assemblyman Arambula

AB 2330- this would require the state to do an economic study on the impact of state regulations on small businesses. The Small Business Advocate would oversee this.

AB 3058-this would amend the duties of the Small Business Advocate to include advocacy on state policy and programs related small businesses regarding disaster preparedness and recovery,including providing technical assistance.

Both bills have passed the Assembly

Dennis you have your work cut out for you[ Dennis Trinidad is the state Small Business Advocate]

SB 1436-This bill is sponsored by Small Business California and is authored by Senator Liz Figueroa. It would require the Department of Technology Services to create a link to state agency Web sites at the State of California Internet portal for small business to access information about start up requirements and regulatory compliance.

It also requires each state agency to designate one individual who shall serve as a small business liaison for the agency, with specified duties that include reviewing and updating content on the agency website that is on the agency website that is accessible through the small business link at the state of California Internet portal and assisting the agency secretary.department director,or executive officer in ensuring that procurement and contracting processes are administered in order to meet or exceed the 25% small business participation goal.

This is on consent calendar of the Assembly Appropriations committee and has passed the Senate. It will go to the Assembly floor

One other piece of information is that the Office of Administrative Law has approved regulations reimbursing small businesses for providing return to work to injured employees.

Monday, August 07, 2006

Media Advisory

Media Advisory Contact: Ellie Schafer

415-515-8808

Release of study conducted showing Small Businesses are the backbone of San Francisco Economy

Mayor Newsom,* Small Business Advocates

WHO: Small Business Advocate Scott Hauge, Jordana Thigpen, President of the Small Business Commission, Stephen Cornell, SF Small Business Advocates, Pat Christensen, President of SF Small Business Network as well as Mayor Gavin Newsom* and Assemblyman Leland Yee*

WHAT: Small Business Advocates will release and discuss a new study regarding small business in San Francisco.

WHERE: Front Steps, San Francisco City Hall

One Dr. Carlton B. Goodlett Place

San Francisco, CA

WHEN: 11:00 AM Tuesday August 8, 2006

*Schedule permitting

Study shows Small Business drives the economy of San Francisco

98.3% of employers in San Francisco are small businesses

with less than 100 employees

August 8, 2006 Contact: Scott Hauge

For Immediate Release 415-680-2109

SAN FRANCISCO – Today, Cal Insurance released a report which studies the economic impact of small businesses on the San Francisco economy. The study looks at the performance of San Francisco’s economy in the deepest and most extended recession the City has experienced since the great depression of the 1930’s; with the conclusion being Small Business drives the economy of San Francisco.

San Francisco had 111,674 small businesses which equaled 99% of all private businesses in the City as well as 55% of the private workforce (331,395 small business people). Perhaps the most impressive figure is small businesses in the City produce a 14.4 billion dollar annual payroll. Scott Hauge stated of the figures, “Small business is the crux of the San Francisco economy.”

One of the most eye opening figures is the fact that small business released less than 10% of their employees during the recession while large business released more than 20% of theirs, despite the two groups of businesses having similar shares of the pre-recession private employment.

“San Francisco City Government clearly needs to develop an attitude that will create and facilitate small business and we hope this study will encourage them to realize this City’s fullest potential; embrace small business and create a pro-small business atmosphere,” said Hauge.

Perhaps some of the most startling figures released in the study show that of the job losses in SF during 2000-2004, 71% of the jobs lost were of large employers. Although some small businesses lost employees, the number of small businesses operating during this time actually increased 2%.

Under the guidance of the Proposition I, which was recently passed by the voters of San Francisco, Mayor Newsom will conduct an Economic Development Study. The City will gather business representatives from across the board and Hauge said, “Small Business not only deserves a seat at this table; they have earned a seat at this table.”

“San Francisco has always had forward thinking residents and it’s time that City government catches up and realizes that small businesses are driving the economy of this city,” said Hauge.

Full details of the 110 page report can be viewed at:

http://www.cal-insure.com/SmallBusinessImpactReport.pdf

Economic Impact of San Francisco Small Businesses

FACT SHEET

San Francisco had 112,431 Business employers in 2004. 111,674 of them were small businesses and/or non-employer groups (mainly but exclusively self employed).

Non Employers 69,252 100-240 Employers 514

0-4 Employers 29,994 250-499 Employers 141

5-9 Employers 5,264 500-999 Employers 66

10-19 Employers 3,649 1000+ Employers 36

20-49 Employers 2,640

50-99 Employers 875

Small Business Total 111,674 Large Business Total 757

Businesses with four or fewer employees, counting self-employed persons as a business with one employee, represented 88% of all San Francisco businesses

San Francisco Large Businesses dropped $3.1 Billion between 2000 and 2003; 2.4 times the comparable drop in the small business payroll

Small Business' percentage of Total Business Payroll jumped from 50.9% to 54% between 2000-2003

San Francisco's unemployment rate climbed from 2.8% in 2000 to 7.4% in 2002. Despite beginning a modest decline in 2003, the unemployment rate remained above 5% through the first quarter of 2006

San Francisco's vacancy rate for Class A office space soared from 4% in 2000 to 21% in 2003 and remained at this peak through 2004. The vacancy rate for Class B office space rose from 5.6% to 17% in the same period

Between 2000 and 2004, San Francisco

lost nearly 100,000 jobs representing nearly 16% of the City's private employment

lost nearly $1billion in payroll

lost 28% of its out-of-town visitor stream and the market it represents

San Francisco lost nearly a quarter (23.9% or 70,280 employees) of its large employers. These jobs represented 21% of the work force of large employers and 71% of all City based jobs.

Small Business represents 55% of jobs in SF in 2003 (42.5% as employees and 11.5% as self-employed entrepreneurs)